The Complete Guide to Identity Continuity

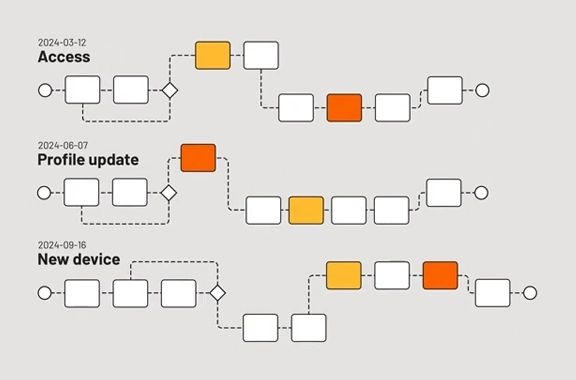

Identity Continuity consolidates all areas identity verification and authentication into a single record, giving your customers simple, secure cross-channel access.

Let us know how we can assist you

See why many of the world’s strongest brands chose Daon to help them build lasting trust with their customers.

Identity Continuity consolidates all areas identity verification and authentication into a single record, giving your customers simple, secure cross-channel access.

Despite their increased security and convenience, myths and misconceptions around digital identity and biometrics abound. Daon is here to help debunk them.

Stolen and synthetic identities factor more and more frequently into the growth of fraud. Finservs should look to biometrics-backed IDV for a secure way forward.

Deepfake creators can reach nearly 52 billion social media users in a few clicks. Learn how to protect your employees and your brand’s reputation from deepfakes.

The ease of using national eID anywhere in the EU is expected to produce significant benefits for citizens, businesses, and governments. Learn more.

Our lives are a blend of digital and physical experiences. But does the future lie in solely digital identity? Read more.

As new banking and payments technologies emerge, fintech regulations are changing at an equally rapid pace. Biometric MFA can keep your business secure and compliant.

Healthcare data breaches are costly – for brand, business, and the customers they affect. Learn how biometric MFA can prevent fraud and a bad reputation.

Reusable ID, popularized by digital wallets, allows users to authenticate themselves across service providers, saving time and money, and increasing security for all.

Black box identity solutions provide a static digital strategy in an era where flexibility is necessary for any business to succeed long-term. Read more.

Take a deep dive into the implications and solutions for what could be one of the most defining issues in digital identity: AI and ML bias.

Greater vigilance over authentication protocols and passwordless, biometric security is needed amidst today’s threat landscape.

Daon and the FIDO Alliance share insights into how passkeys can improve user experience, increase security, and scale to your business needs.

Relying parties can take action now to promote digital literacy and allow more consumers to benefit from their products and services.

Seeking out third-party security providers that offer enhanced tech is critical to the future of telecoms – but using advanced solutions in-house is even better.

Understanding how biometric data collection functions is key to quelling customers’ concerns around the collection, security, and use of their biometric data.

With FCC 23 95A implementation coming this summer, telcos need to upgrade their security technology to remain compliant and competitive. Learn more.

Wider acceptance of biometrics for travel use cases is reducing friction, increasing customer satisfaction, and streamlining experiences for travelers worldwide.

Healthy outcomes are critical, but recent data show how a positive patient experience can be nearly as important in today’s healthcare landscape. Learn more.

In the shadowy corners of the internet, a new threat emerges: OnlyFake. Learn more about AI-generated fake IDs and how Daon can help combat evolving cyberthreats.

Financial services are turning to biometric verification for safer, faster, and more accessible account and access management. Learn more.

As 2024 begins with fraud top-of-mind for both businesses and customers, here’s a look at the modern fraudster and how to beat them at their own game.

The recent robocall of President Biden has raised international concerns about AI. Here’s how xSentinel can protect against voice deepfakes.

Watch this on-demand webinar to learn strategies you can use to mitigate synthetic voice fraud, deepfakes, and more.

Verifiable credentials and secure biometrics are powering the next generation of digital identity via digital wallets, national IDs, and more. Read now to learn how.

Identity fraud incidence continues to increase as we enter 2024. Businesses across sectors need to arm themselves against generative AI, ATOs, and more.

Digital identity verification can help your organization secure its remote or hybrid workforce through safer account logins, onboarding, and data access.

For industries regulated by age restrictions surrounding media, biometrics-powered digital identity verification is critical.

PAD has emerged as a reliable, secure defense against spoof attacks. Learn how to ensure that only genuine users access accounts and services.

Identity proofing and authentication solutions are critical to the success and security of businesses across industries. Read to learn more.

Learn more about the growing threats around identity fraud faced by financial institutions and steps that can be taken to give them the upper hand against bad actors.

Face recognition, when combined with step-up authentication, provides an identity assurance paradigm that’s resilient and futureproof.

Learn how to save money and improve customer experience while protecting your contact center from identity fraud.

Password-based authentication is costly for everyone: customers, organizations, and employees. Read how you can better protect your data and your people with passkeys.

The benefits of biometric authentication extend beyond just protection from phishing scams: they can save businesses millions in fraud costs annually. Read more.

Modern digital customers want convenience and security. But how do you protect their data without adding friction to customer experiences? Read to learn how.

Identity verification is the key to keeping your organization and the people it serves secure. Read more to learn how AI can take that process to the next level.

Decentralized identities (DCI) are gaining popularity as a potential solution to the problems that centralized identity management systems present. Learn more.

Voicebots and AI-powered deepfake technology has contact centers being forced to rethink their security strategies. Here’s how Daon xSentinel can help.

The FIDO Alliance’s mission is to proliferate ease of use, privacy and security, and standardization surrounding authentication. Learn more.

Digital identity management is a balancing act between security and UX. Biometric authentication is the futureproof solution modern organizations should implement now.

Partnering with a digital identity specialist could have an invaluable impact on your business, from cost savings to customer acquisition to data security. Learn more.

Biometrics play a key role in the effective implementation of identity verification and authentication for large-scale, secure, digital identity credentialing systems.

Daon’s deepfake fraud indicator, xSentinel, alerts organizations to voice cloning attacks, offering a potent defense in audio-based authentication systems.

Learn about the critical need for continuous innovation in deepfake and synthetic identity detection methods, regulatory policies, and advanced algorithms.

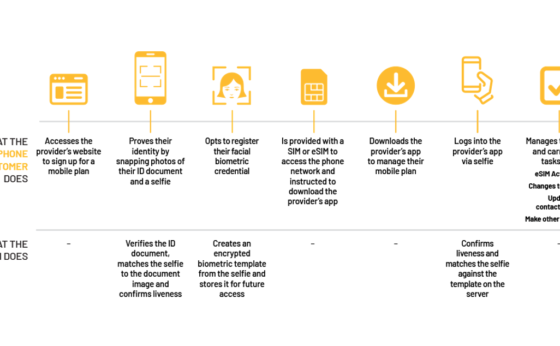

Preventing eSIM fraud is as easy as using a single-platform Identity Continuity solution that leverages MFA. Read the full eBook to learn how.

In this webinar replay, explore deepfakes and voice cloning, why presentation attacks are becoming prevalent across industries, and more.

By removing onboarding barriers that people living with disability often encounter, identity verification and authentication fosters equal access for all users.

Experts from NatWest, AIB, & BankID, covered how FIs use digital identity programs for customer experience, security, and regulatory requirements.

eSports organizations are turning to companies like Daon to prevent fraud, especially a form of cybercrime known as smurfing, and to improve player experiences.

Identity Continuity eliminates dangerous gaps between siloed digital identity processes and lets you build customer journeys that create trust, not friction.

Some of today’s most common authenticators are failing to provide the security required to keep IAM systems and customers safe. Read more.

Learn how identity verification and authentication can help your organization mitigate medical identity fraud, improve patient engagement, and shore up your revenue cycl...

Imagine onboarding verified customers to a single record that can be securely accessed at any time, from anywhere, minimizing fraud and maximizing customer experience.

Learn how to securely verify the identity of an employee or customer when they are managing their credentials or recovering their accounts, from this Gartner report.

John Duggan, EVP, APAC, discusses the positive effects that implementing biometrics for onboarding and authentication can have on the banking customer experience.

Wema Bank partners with Daon to improve platform security with face biometric verification and authentication.

Daon partners with Wema Bank in Nigeria to deliver identity verification and authentication for secure bank account setup. Read the full press release.

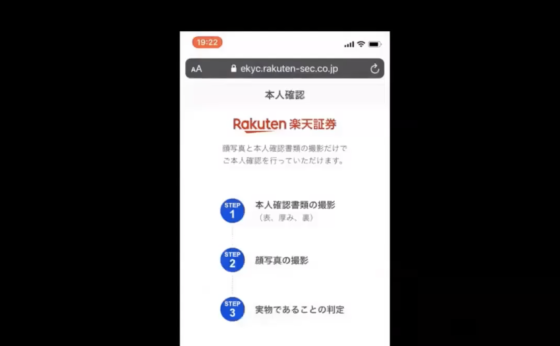

Get a high level overview of the benefits of eKYC for your business before diving into how Daon can make those benefits a reality.

Daon President of the Americas, Bob Long, joins the conversation about the growing threat of voice cloning and how technology is the best defense.

Daon CEO, Tom Grissen, shares his insights on the value of Identity Continuity for creating robust, user experience-focused identity security.

Heirs Technologies is partnering with Daon and other best-in-class technology providers to bring emerging technology solutions to Nigeria.

Daon partners with TAN to create a safe, inclusive, and accessible gaming community that will remove barriers for players to game & prevent account fraud.

Voice biometrics has become a battle of good AI vs. evil AI. Conor White shares insights into the state of the technology and what is being done to help good AI win the ...

Telefónica deploys Daon identity verification solutions across its channels to protect Movistar and O2 customers from ATOs, SIM swaps, phishing, and deepfakes.

Qualcomm’s tech collaborations with Daon and other industry partners are leading to development of next-gen auto insurance options, biometric payments, and more.

International publication, IT Brief, shares details about the launch of xSentinel, Daon’s newest defense against synthetic voice, across their many sites. Read the...

Netherlands-based publication, The Paypers, shares details on the launch of Daon’s latest synthetic voice detection tool, xSentinel. Read the full article.

Daon is chosen by Enterprise Security Magazine as a Top 10 Digital Security Solutions Provider for 2023. Read the full article to learn what sets us apart.

BiometricUpdate.com covers Daon’s latest release of xSentinel, an adaptive synthetic voice protection product. Read the full article.

Daon’s new xSentinel product provides adaptive synthetic voice protection for all voice communication systems. Read the full press release.

From enhanced security to regulatory compliance, learn how xFace provides advanced authentication for your organization while enhancing customer experience.

D.A.O.N. Fall 2023 is filled with great reads on deepfake and AI, fostering financial inclusion, improving customer experience, the price of password recovery, and more....

From videos and masks to deepfakes and injection, learn how Daon helps to ensure a real person is connecting with your organization.

Daon is a key component of Tonik Bank’s mission to provide financial solutions for the 70% unbanked population of the Philippines.

President of New Industries, Conor White, writes on how eSports companies can solve one of their biggest issues with identity verification and authentication.

D.A.O.N. Summer 2023 includes a recent development in our anti-deepfake technology arsenal, AI.X™, why Identity Continuity is the best defense against fraud, and how Dao...

Finovate, a leading fintech, banking, and FS organization, picks up the news about Daon’s new AI.X technology offering in this article by Julie Muhn. Read more.

Daon’s new AI.X technology will protect against deepfakes across voice, face, and document verification. Read the full press release.

Daon’s President & CPO Ralph Rodriguez writes about the power of AI, the reality of deepfake technology today, and more. Read the full article.

Biometricupdate.com covers two Daon developments: the granting of new patents, and our partnership with leading esports company, ESL FACEIT Group.

Daon secures two new patents that enhance the verification process for government-issued IDs, bolstering Daon’s solution offerings. Read to learn more.

Daon is providing ESL FACEIT Group with solutions to improve gamer experiences, stop identity fraud, prevent financial loss, and combat negative activities tied to multi...

Ralph Rodriguez explores the benefits of MFA and SaaS-based solutions for protecting small to medium enterprises from identity fraud.

Daon’s top-tier biometric authentication solution was recognized by Frost & Sullivan for its accuracy, robust security, and more.

ESL FACEIT Group announces the launch of their new identity verification system for eSports, FACEIT ID, powered by Daon.

This Spring edition of D.A.O.N. includes the launch of our new product, TrustX®, why biometric authentication is the key to smarter banking, and how Daon was named T...

FindBiometrics writes: “TrustX was developed with a focus on making it easy for organizations to manage their users’ digital identity lifecycle, offering a no-code...

Biometricupdate.com’s Masha Borak covers the TrustX launch, key features of the innovative platform, and how biometric authentication can be leveraged on TrustX by...

Bob Long, president of the Americas at Daon, speaks with Enterprise Ireland about how biometrics can revolutionize the future of passwordless identity journeys for the f...

The Paypers writes about TrustX, its key features, and how the new Identity Continuity platform can help businesses of any size perform highly secure identity verificati...

CSO Online covers our newest product release and how TrustX’s AI/ML-powered platform builds, authenticates, and manages identity journeys through no-code, drag-and-drop ...

Daon unveiled TrustX®, its next-generation cloud-based platform for identity verification and authentication across digital identity lifecycles.

Daon’s President of New Industries helps set the stage for an in-depth conversation about how and why biometrics is poised to transform healthcare, automotive, and...

Our new SaaS-based platform that provides the speed, flexibility, and low overhead of managed hosting along with no-code, drag-and-drop orchestration.

Daon to demonstrate healthcare offerings for patient and provider identity verification and innovative solutions for restricted substance distribution at HIMSS

Bizboxes offers an innovative app-enabled control platform for secure and convenient delivery of controlled items in retail, healthcare, and other industries.

The state of security in UK banks and how modern technology is facilitating more robust customer authentication and improving the identity verification experience.

John Duggan, SVP of A/NZ & South East Asia, speaks to why Enterprise Security named Daon a Top 10 Digital Identity Solutions Provider in the APAC regions.

Consumer expectations for digital security have evolved. Here’s how your organization can keep up, according to Clive Bourke, President, EMEA & APAC.

Identity fraud losses in 2022 alone amounted to $52 billion. Click here to read which identity verification trends we’re predicting for 2023 and beyond.

Healthcare fraud has significant costs, both financial and non-financial, that affect individuals, healthcare providers, and society as a whole. Learn more.

Builtin.com picks up an article about Zero Trust Consumers written by our President and CPO, Ralph Rodriguez. Click to learn more and read the full feature.

“5 Things to Know About Passkeys for the Enterprise,” by Daon’s CPO, Ralph Rodriguez, is picked up by Brilliance Security Magazine. Read more.

Daon has been named ForgeRock’s 2023 CIAM Partner of the Year. The award recognizes a CIAM partner that offers superb technical execution. Read more.

Daon uncovers generational gaps in adoption rates of identity security technologies and a desire for anti-fraud solutions across ages. Read more.

Daon research and solutions are cited in an overview of 2023 voice biometrics technology trends by Speech Technology magazine. Read more.

Daon expands its senior leadership team to scale business into new markets with a key executive promotion for Conor White and a new hire, Bob Long.

CIAM-enhanced customer personalization can give you happier, safer, and more satisfied customers – all while protecting your business and its data.

Designed to be seamless, invisible MFA provides the same level of security as legacy MFA methods without requiring extra steps for the user.

Identity proofing put us in the driver’s seat. Motortrend reports on Daon’s exciting foray into the software-defined vehicle space alongside Qualcomm.

Read what our worldwide team of innovators has been up to – from software-defined vehicle tech, to a provocative survey about next gen Zero Trust Consumers.

The ONC Cures Act Final Rule and FHIR implementation is changing digital healthcare. Learn how healthcare organizations and their IT departments must adapt.

Using CIAM (Customer Identity and Access Management) can help any financial organization reach (and keep) customers whose UX expectations are at an all-time high.

Software-defined vehicles are the smartphones of the near future, and they’re powered by customer-centric identity authentication. Read more.

Identity verification is an important process that can keep you and your personal information safe online, in-person, and on the go. Learn more about how it works.

Multi-factor authentication can help businesses attract and retain customers with convenient UX and highly secured transactions. Learn more.

Let’s look at three terms which comprise the two separate identity processes (verification and authentication) that are critical for a wholistic KYC strategy.

Biometric identity verification provides unique, virtually un-hackable layers of security. And it comes in many shapes and sizes: from who you are, to what you know, to ...

Using biometric factors for authentication is the most secure and convenient way to give your customers and employees account access. Learn more.

Document verification has a wide range of use cases and is critical to ensuring the authenticity of identity documents. Learn how to build instant digital trust.

Here’s what every business needs to know about eKYC (electronic Know Your Customer) and how it can secure and streamline onboarding processes across industries.

Digital identity certifications establish trust between the service provider and its client. Learn more about certifications, like the UK’s DIATF.

Watchlists use on-server biometric facial template data to create a powerful barrier against fraud and bad actors. Read more.

BiometricUpdate shares information on the integration of the Daon IdentityX platform with ForgeRock’s Identity Cloud.

WebAuthn, a FIDO protocol and an identity authentication standard, allows users to authenticate their identities without passwords. Learn more about passwordless auth.

Providing secure mobile authentication for customers is key to any organization’s success online. Read more to learn about the different methods available.

IdentityX is now available on the new ForgeRock Identity Cloud, providing more secure authentication via Daon device-based biometric tech.

Behavioral biometric authentication uses unique, personal characteristics to create a security barrier that is exceedingly difficult to break through. Learn more.

Finding a CIAM solution that meets the unique needs of your organization can help you avoid fines, headlines, and potential lost customers.

Agility PR Solutions analyzes Daon’s report on Zero Trust Consumers. Read more to learn why 9 in 10 of them are skeptical about digital security.

Chief Product Officer, Ralph Rodriguez, is a featured expert in VentureBeat’s article “From passwords to passkeys: A guide for enterprises.”

Daon President, Conor White, discusses what is important in today’s Digital Identity landscape and how Daon is positioned to meet organizations’ needs.

CPO Ralph Rodriguez takes a deep dive into the foundation behind and the challenges created by passkeys. Are enterprises ready to respond to the changes they will bring?...

FIDO ID: learn all about the benefits of this safer, more UX-friendly authentication method and how it mitigates mobile channel fraud.

The award-winning Daon IdentityX platform is now available for global deployment via the Amazon Web Services marketplace. Read our release to learn more.

RWS writer Bruce Christian reports on Daon’s newest global survey of over 3,000 consumers. Read more to learn why 92% of them don’t trust passwords.

Are consumers adopting a risk mindset when it comes to accessing accounts and services online? Daon’s security trends report investigates.

FIDO passkeys, more accurately referred to as multi-device credentials, are cryptographic keys. Learn more about their FIDO2 compatibility.

We surveyed 3,000 anonymously selected consumers. 68% say passwords are their most used, yet least trusted, security measure. Click here to learn why.

Passkeys have been at the forefront of fintech news for months. Will financial institutions embrace a passwordless future, or get left behind?

Implementing digital identity verification for customer onboarding minimizes friction, reduces drop rates, and makes your customer happier.

A new generation of consumers is here, and they expect organizations to meet them halfway when it comes to protecting their personal data online.

Daon enables faster and more secure customer onboarding for Ireland’s leading mails, parcels, and ecommerce logistics company. Read more about the partnership.

Consumer acknowledgment of the risk of conducting different aspects of their lives online signals the emergence of Zero Trust Consumers.

With tech giants going passwordless, will banks be ready to meet new consumer expectations? Ralph Rodriguez, President and CPO at Daon, weighs in.

FindBiometrics.com reports on GoTyme bank leveraging the Daon® IdentityX® platform to secure their newly launched service in the Philippines.

GoTyme Bank, a new digital bank designed for financial inclusion, will utilize Daon IdentityX® for digital identity capture and authentication in its banking app.

Biometricupdate.com reports on Daon’s market-leading biometric onboarding solution being implemented by over 250 credit unions through CU*Answers.

The UK National Cyber Security Centre (NCSC) recently announced new guidelines to help businesses adopt passwordless authentication. Read their recommendations now.

The need for efficient digital onboarding and identity verification has never been greater. Here’s how these practices are contributing to a better future for business.<...

Just announced: Daon and CU*Answers are providing digital identity verification, authentication, and onboarding solutions to over 350 credit unions.

This edition features an interview with Daon CEO, Tom Grissen, and exciting news about how VeriFLY is leading the charge for digitizing travel experiences.

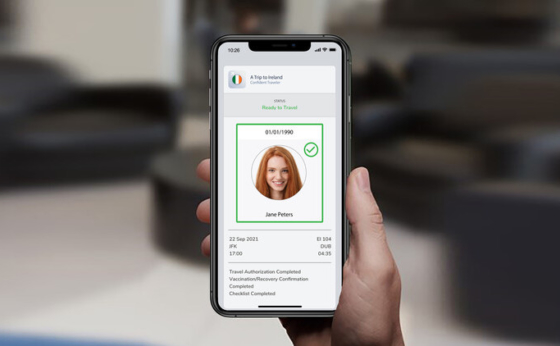

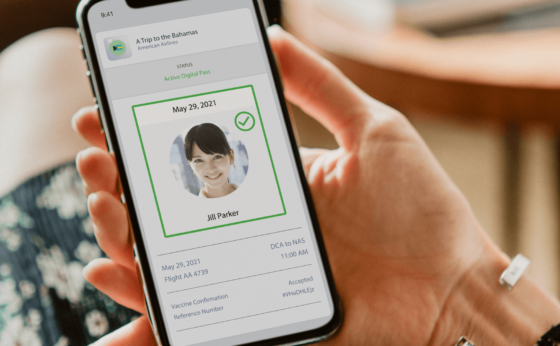

VeriFLY expands its capabilities, enabling users to access full travel itineraries and health documents for a seamless, convenient travel experience.

Daon CEO, Tom Grissen, discusses biometrics, voice technology, and the human side of security in an interview with FindBiometrics Editor-In-Chief, Peter Counter.

Daon CEO, Tom Grissen, shares his thoughts on the future of seamless travel and how VeriFLY is leading that charge with World Aviation Festival.

Daon announces the availability of IdentityX® voice biometrics on the Genesys AppFoundry™, a marketplace of solutions offering applications and integrations.

Watch a replay of our free, informative webinar, “Why Combine Customer Identity Verification and Authentication?”, featuring our expert guest speakers.

New partnership enables Daon to provide an end-to-end authentication solution for contact centers to protect businesses and their customers from call spoofing.

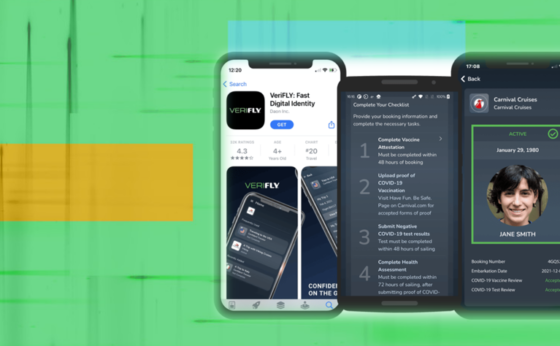

Cruise Industry News reports how Carnival has become the largest cruise line to use the VeriFLY app, with over 1M guests enjoying seamless embarkation.

Cruisehive’s Melissa Mayntz reports on Carnival Cruise Line’s successful implementation of VeriFLY. Over 1M guests have simplified how they travel so far.

Cruiseradio.net picks up Carnival and VeriFLY’s success story of over 1M cruise guests utilizing the VeriFLY app to embark easily, seamlessly, and safely.

One million Carnival Cruise Line guests have now utilized VeriFLY™, a secure, free travel app allowing vaccinated guests to easily submit health screening info.

Biometricupdate.com’s Alessandro Mascellino reports how Ron Dillehay, Carnival’s VP of guest marketing and technology, praises VeriFLY’s time-saving tech.

One million Carnival Cruise Line guests have now used VeriFLY™ by Daon, a secure and free travel app allowing vaccinated guests to easily submit health screening info.

Daon has joined the Ping Identity network by integrating its biometric authentication technology with PingOne DaVinci no-code digital identity orchestration service.

This partnership leverages PingOne DaVinci, a no-code identity orchestration service, and Daon’s expansive biometric authentication offering.

Synthetic fraud is the fastest-growing form of financial crime today, costing financial institutions an estimated $20 billion per year. Here’s how to stop it.

Here’s what the rise of eSIMs (embedded subscriber identity modules) means for telecom providers, their customers, and their identity verification practices.

In this issue, read about key trends impacting AML for cryptocurrencies and how VeriFLY’s capabilities extend far beyond the era of COVID restrictions.

In this technology overview, we’ll show you how to embrace the convenience of eSIMs while cutting costs and strengthening your identity security, too.

Read how one of the world’s largest telcos upgraded their identity system to prevent SIM Swap attacks, handle eSIMs, and speed up customer onboarding.

Daon teams up with Gateway ID Africa to provide life-changing identity self-sovereignty to underserved communities in Africa and beyond.

Ralph Rodriguez, tech pioneer and Gulf War Veteran, is Daon’s new President and CPO. Rodriguez is the longest-serving MIT Fellow and founded Confirm.io.

Daon welcomes Ralph Rodriguez to the team as President and Chief Product Officer. Rodriguez is a seasoned B2B security expert and the longest-serving Fellow at MIT.

In the new issue of IATA Airlines Magazine, our CEO shares how the benefits of VeriFLY are “just getting started,” even as pandemic restrictions ease.

Gateway ID Africa’s inclusive platform, launching later this year, will connect underserved users with life-changing public and private services.

Watch now to see why Broadcom has partnered with Daon, the global leader in biometric IDV, to help make SiteMinder even better at protecting your applications.

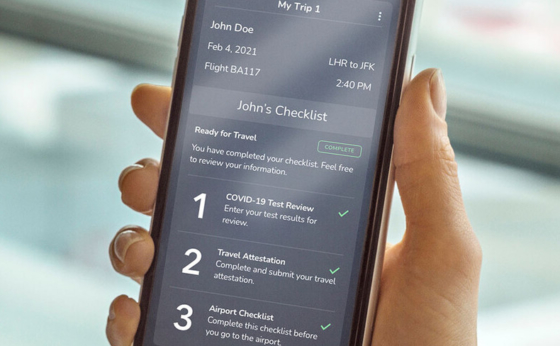

American Airlines uses VeriFLY to make an island escape even breezier. Read how one traveler took only 5 minutes to complete their pre-board checklist.

Consult Hyperion reveals the 6 identity events your customers dread most, and how you can remove the friction and frustration from each one.

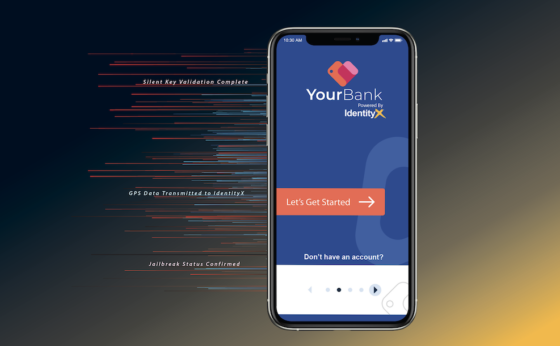

Here’s the scoop on silent authentication, a FIDO-like way of authenticating a device using a public/private key pair with zero user interaction.

Watch how creating instant digital trust leads to lower abandonment rates, happier customers, and stronger security and AML/KYC compliance.

Watch our head of solutions engineering introduce a new approach to authentication, combining FIDO with server-side identity verification and recovery.

If you’re a SiteMinder customer, watch just how fast, easy, and affordable biometric identity verification can be in this 2-minute video.

Watch Forrester’s Andras Cser discuss how to stop synthetic fraud, the fastest growing form of financial crime today, and one of the most difficult to detect.

In this issue, read why Enterprise Security magazine chose us as a top-10 MFA provider and what Gartner’s new market guide has to say about identity verification.<...

Cruise Fever reports on Holland America Line’s new and improved embarkation process, complete with VeriFLY vaccination verification from Daon.

BiometricUpdate.com’s Tyler Choi reports on Holland America Line’s expanded adoption of the VeriFLY digital wallet for COVID vaccine verifications.

Holland America Line is enhancing the preboarding guest experience by bringing VeriFLY vaccine verification to all its U.S., Canadian and European homeports.

Learn how our full-circle professional services program delivers an assured path to implementation success and continuous improvement.

Read how a market-leading telecommunication provider delivers passwordless digital services to its customers, secured by strong FIDO authentication.

After a successful pilot, Carnival announces the launch of Daon’s popular digital health wallet fleetwide, for all ships in all of its U.S. homeports.

Watch a replay of Daon and Digital.FI’s webinar, “Delighting Credit Union Members in the Digital Age,” to hear digital strategies for improving UX.

CNBC’s Kenneth Kiesnoski shares his experience using the VeriFLY app and a COVID self-test kit to streamline his return home from Spring Break in Mexico.

Enterprise Security magazine interviews Daon’s Conor White in honor of his company’s selection as a top-10 multi-factor authentication provider in 2022.

Daon “believes that many of the trends that have been observed during the pandemic will continue and even accelerate,” writes FindBiometrics.

Carnival Cruise Line is implementing a digital passport app called VeriFLY to streamline the embarkation process, writes Travel & Leisure.

Carnival becomes the largest cruise line to use the VeriFLY digital health wallet for its operations from U.S. homeports, expects rapid expansion.

Carnival Cruise Line begins using Daon’s popular VeriFLY technology pre-cruise to help speed-up passenger embarkation, writes Cruise Critic.

Carnival Cruise Line announced today it will become the largest cruise line to use the VeriFLY solution for its operations from U.S. homeports.

In this issue, read our top biometrics predictions for 2022 and a new Gartner report on the 3-step path to passwordless authentication.

Daon is making it easier for organizations to take advantage of its IdentityX identity verification & proofing solution reports Findbiometrics.

Daon proudly announces the launch of its next-generation, fully hosted, ready-out-of-the-box identity verification and proofing solution.

Watch a 4-minute video demo of our new and improved, fully hosted, ready-out-of-the-box identity verification and proofing web application.

Read how we’re delivering more back-end power, more data visibility, and more fine-grained control over your verification decision making than ever before.

Conozca a su cliente mucho más rápido. La solución de verificación y prueba de identidad más abierta, flexible y poderosa del mundo lista para usarse.

Maior agilidade para conhecer o seu cliente. A mais aberta, flexível e poderosa solução para verificação e comprovação de identidade está pronta para uso.

Tradewinds Aviation becomes the latest airline to choose the VeriFLY digital wallet for COVID rules compliance, writes Biometric Update.

Daon announces the exclusive use of its digital health wallet VeriFLY for meeting all COVID-19 requirements at a major aviation conference in Hawaii.

Daon has partnered with regional air mobility leader Tradewind Aviation to provide VeriFLY access to customers traveling in the Caribbean.

Premium international business travelers on American and British Airways flights between the US and UK will receive VeriFLY-ready COVID test kits.

Vaccination certificates can be registered for the first time in Japan thanks to an ongoing partnership between Japan Airlines and Daon’s VeriFLY.

American has created an easy-to-follow recipe for international travel, featuring pre- and post-flight resources and a Ready to Fly checklist.

This research includes in-depth conversations with 12 business leaders on using frictionless biometrics across all channels of engagement.

As the U.S. reopens on November 8, Aer Lingus’ extended use of the VeriFLY app will enhance the customer experience for even more air travelers.

Watch identity leaders from Goldman Sachs and Royal Caribbean discuss improving authentication experiences for every customer and contact. (Nov ’21)

Join identity leaders from Capitec Bank and Tonik Digital Bank to learn why organizations all over the globe are now embracing digital onboarding. (Oct ’21)

Business Traveller reports on the long-term agreement between British Airways and Daon for expanded use of the popular VeriFLY app.

Following its successful VeriFLY trial, British Airways has signed a long-term agreement with Daon and aims to cover its entire route network by year’s end.

This 2021 research report from Goode Intelligence analyzes the new rules for modern, user-centric digital onboarding, and why your customers demand it.

Which authentication factors reign supreme? Join Opus Research as we compare and contrast modern biometric factors like face, voice, and fingerprint. (Oct ’21)

This new report from the CMO Council and BPI Network explores the new imperative for unifying customer authentication methods in today’s connected economy.

In this issue, read about the inspiration behind our new website and why Opus Research named Daon one of its “Vendors That Matter.”

Biometric Update reports on a global thought leadership initiative from Daon, the Business Performance Innovation (BPI) Network and the CMO Council.

We’re partnering with the BPI Network and the CMO Council to explore consumer attitudes toward current authentication processes and the future of verification.

Here’s how authentication using soft tokens on your smartphone can help you save money, remove friction, and maintain strong security for your customers.

Meet your customer Jill. Her life is complex, but her identity life can be simple—with a seamless journey through the customer identity lifecycle.

Read why adaptive identity verification is the key to building customer lifetime value, and why it led Opus Research to name Daon a “Vendor that Matters.”

Read how an iconic bank prevents cross-channel fraud while enhancing the customer identity experience across mobile, web, and contact center interactions.

Watch how we make digital identity verification a fast, safe, and seamless part of the onboarding process, so you’ll get lower abandonments and happier customers.<...

Hear how the first digital-only bank in the Philippines made banking with remote identity verification and onboarding a safe, social, and downright enjoyable experience....

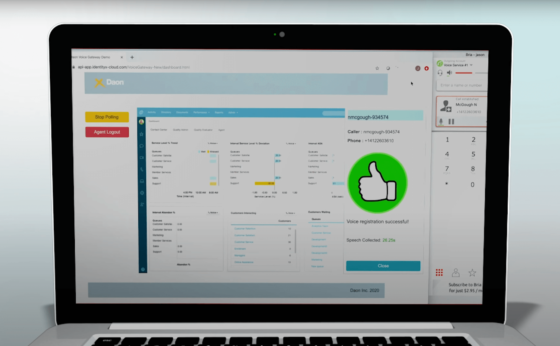

Watch a contact center agent use passive voice biometrics to authenticate a caller in seconds, without any customer friction whatsoever.

Read how Japan’s largest mobile payment app streamlines the digital onboarding experience for its customers while satisfying eKYC compliance mandates.

Read how a mobile app reimagined communication between pension schemes and their members, creating a simple, reliable process for demonstrating proof of life.

Read how a joint venture of SMFG/SMBC, Daon, and NTT Data ignited the Japanese market for real-time, cross-channel biometric authentication and eKYC.

Read how a major U.S. credit union uses Identity Continuity to save millions, cut account takeovers in half, and deliver seamless, cross-channel member journeys.

Read how an iconic group of banking brands is looking to the future with secure, convenient biometric banking that meets robust compliance requirements.

Listen as Daon’s Senior Legal Counsel explains the rules of GDPR, the definition of “explicit consent,” and how Daon ensures its customers stay fully compliant.

Join PNC’s Head of Digital ID & Fraud and Daon’s Head of Engineering for an irreverent chat about biometrics and liveness detection. (Aug ’21)

Research firm Goode Intelligence analyzes the return on biometric authentication in financial services, with input from Atom Bank, BNP Paribas, SMBC, and others.

In this issue, read how major financial institutions are reacting to an increase in fraud attacks and about the resurrection of commercial air travel.

Learn how marrying identity technologies and personal health attributes can lead to a safer, faster reopening of workspaces, event venues, and other facilities.

Listen in as Daon’s global head of human resources describes what makes an ideal candidate and shares a peek inside Daon’s company culture.

Listen as the co-chair of the American Bar Association’s ePrivacy Law Committee shares what you need to know about the California Consumer Privacy Act.

Daon CEO Tom Grissen explains the emotional aspect of creating consumer trust and predicts how businesses and consumers will change over the next ten years.

Join our head of solutions engineering in the EMEA region for an overview of the PSD2 SCA requirement and his 5 simple rules for successful compliance.

Hear from one of the fastest growing fintechs in the Gulf on customer onboarding as the gateway to a unified virtual banking market of 34 million GCC nationals.

Hear the APAC region’s perspective on digital onboarding, including customer trends and demands across various market sectors and geographies.

Hear how the UK’s first app-only bank and the first to use face and voice biometrics-views mobile-optimized banking and the future of the industry.

Read how we’re helping government offices face the challenge of continuing to process claims and promptly issue payments while reducing rampant fraud.

Hear how online-inspired technologies can dramatically improve the caller experience, stymie fraudsters, and save millions in the process.

Frequently asked questions and straightforward answers on why, how, and when to deploy a FIDO-certified identity platform like Daon’s IdentityX.

Listen as Daon’s Chief Technical Architect explains how to enhance security, manage complexity, and optimize usability with multi-factor authentication.

Hear the latest on FIDO2, including Apple’s move to add Touch ID and Face ID to the web with Safari 14 and the use of “discoverable credentials.”

Listen as Daon technical architect Ronan Hickey explains public-key cryptography, the FIDO Alliance, and the impact of FIDO2 for web authentication.

Watch Daon CEO Tom Grissen explain why privacy rights and customer empowerment are key to risk-based safety in healthcare and other industries. (Aug ’21)

Read how New Zealand citizens use verified digital identities to access public services online, open bank accounts, and even apply for student loans.

Watch how digital banking customers benefit from using Daon’s biometric-based identity assurance when accessing their accounts online.

Read how a digital banking innovator enhanced its biometric authentication performance while cutting costs and keeping the migration seamless for bank customers.

Learn how liveness detection prevents the spoofing of biometric credentials and which techniques and technologies are most effective.

Follow Goode Intelligence analysts as they investigate the best identity practices for helping individuals build trust online while balancing security and convenience.

Learn about the role biometrics plays in the PSD2 Strong Customer Authentication requirement and why achieving compliance doesn’t mean sacrificing convenience.

Go behind the scenes with Daon’s Senior Research Scientist, Dr. Mark Kane, to explore how researchers build and refine biometric models and combat spoofing.

Watch Daon’s President of the Americas Conor White explain how banks and other institutions can profit from the continuity of identity experiences. (Jul ’21)

Learn the best ways to keep fraudsters out of your contact center without making true customers feel like suspected criminals.

Here’s a quick primer on how NFC works, its origins in government security, and how those benefits extend to remote identity verification of your new customers.

British Airways, Virgin Atlantic and Heathrow will launch proving trials to simplify travel rules for fully vaccinated customers on selected flights.

Watch Opus Research and Daon discuss the security, convenience, and continuity dimensions of the digital customer onboarding process. (Jul ’21)

mTrip will integrate the VeriFLY digital wallet into its white-label mobile applications to dramatically improve the travel experience worldwide.

USA Gymnastics will feature the VeriFLY™ digital wallet at its U.S. Championships event to help athletes and fans track COVID safety requirements.

Frosch integrates “Obex for Business” app with VeriFLY digital wallet, allowing travelers to access COVID-19 test results and vaccine certifications.

VeriFLY™ is now the first digital wallet to accept vaccine health credentials around the world, bringing new convenience and peace of mind to travelers.

Biometric Update reports on Daon becoming the world’s first digital health wallet to accept vaccine confirmations in addition to test results.

American Airlines customers can now choose a convenient vaccine verification option when using VeriFLY and can also access expedited check-in lanes.

Join members of the Bedrock Consortium for a look at the first decentralized identity utility established by global companies for global consumers. (May ’21)

Polarify GM Jiro Matsuyama joins Daon’s Clive Bourke to discuss how Rakuten and others use remote IDV to keep pace with digital demand. (May ’21)

We’re sharing the top 5 ways to eliminate pain points in remote identity verification, so you can onboard customers more swiftly and build higher levels of trust.<...

Watch PNC’s head of digital ID & fraud explain why FIDO-certified authentication is key to an audacious new digital banking transformation. (Apr ’21)

Unemployment fraud is on the rise, but advanced biometrics make impersonating a citizen exceedingly difficult, even with all the stolen credentials on the Dark Web.

With customers demanding more convenient and safer ways to access their money, here’s how biometrics will shape the next twenty years of banking.

Japan Airlines is launching a trial with three health credential apps, including Daon’s VeriFLY, to help create safer, more seamless travel experiences.

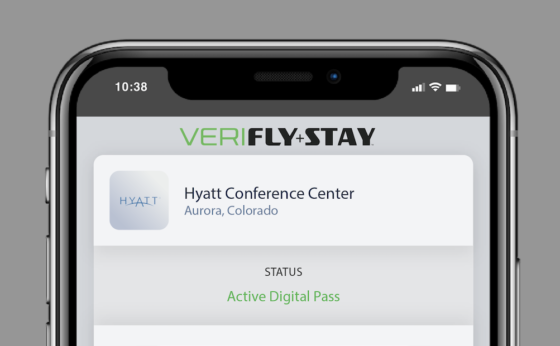

Hyatt plans to utilize the VeriFLY digital wallet extensively as a means of enhancing wellbeing and peace of mind for employees and event attendees.

FindBiometrics reports on Daon’s VeriFLY charging into the events space and striking a deal with the Pennsylvania Convention Center in Philadelphia.