How To Stop Synthetic Fraud

Here's How to Stop Fraudsters in Their Tracks and Keep Your CIAM Secure

Silent and costly, the fastest-growing form of financial crime might surprise you with its sneaky tactics. Here’s the scoop on how using document-centric biometric identity verification can stop synthetic fraud before it takes root in your CIAM.

The perfect storm of identity fraud

Synthetic fraud costs financial institutions an estimated $20 billion per year(1). Fraudsters will steal, on average, between $81,000 and $97,000 before their schemes are detected(2).

Synthetic identities use data points like Social Security Numbers and false PII (personally identifiable information), often collected from children and deceased persons, to form a credible identity. This is a form of “victimless fraud” – since these identities are manufactured, rather than stolen, no one notices, and no one is prompted to report the crime.

Fraudsters can add synthetic identities as authorized users to credit cards, loans, savings accounts, and more. They can even utilize the ID to prompt a “new life” with credit card bureaus; they’ll wait a few years, take out loans, and never repay them.

Worse than identity theft?

According to Experian, 72% of financial executives surveyed believe synthetic identity fraud poses a greater challenge than identity theft.

- Synthetic fraud is the fastest-growing form of financial crime today.

- Once successfully onboarded to your CIAM (Customer Identity and Access Management), synthetic identities look just like legitimate customers; your traditional fraud prevention tactics (e.g., step-up authentication) won’t work.

- Businesses often adopt friction-filled onboarding processes in response to synthetic fraud attacks—antagonizing their legitimate customers and increasing abandonment rates.

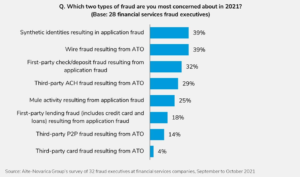

Suspicions Confirmed

In fact, the type of fraud that security executives at financial services companies are MOST concerned about, according to a recent survey, is – you guessed it – synthetic fraud(3).

What You Can Do

The best way to fight this type of fraud is to not fight it at all…

…instead, stop it BEFORE it starts.

How?

By using document-centric biometric identity proofing and verification: a simple, highly effective way to keep synthetic fraudsters at bay. Here’s how it works.

Choosing the Right Identity Verification Solutions for You

- Pick a deployment that suits your needs: on-premises or hosted; native or web app.

- If IDVaaS is an option, find the most powerful solution. Preferably, one that’s fast and inexpensive to both integrate and deploy.

- Make sure your solution supports thousands of government-issued document types from around the globe.

- Consider pre-built integrations with external data sources (Experian, AAMVA, LexisNexis, etc.) and how they can force-multiply your IDV efforts with nominal cost and little complexity.

- Think about real-world environments. Biometric technologies might test well in the lab, but struggle in the field. Proper solutions are thoroughly battle-tested and able to scale alongside your business.

- Futureproof your investment with an open platform provider that fits your current and future authentication needs.

Click here to watch a webinar replay, where you’ll learn how to keep synthetic fraud out of your CIAM and hear some key points about anti-fraud best practices in today’s constantly changing digital landscape.