Is There Bias in AI and ML?

Take a deep dive into the implications and solutions for what could be one of the most defining issues in digital identity: AI and ML bias.

Let us know how we can assist you

See why many of the world’s strongest brands chose Daon to help them build lasting trust with their customers.

Take a deep dive into the implications and solutions for what could be one of the most defining issues in digital identity: AI and ML bias.

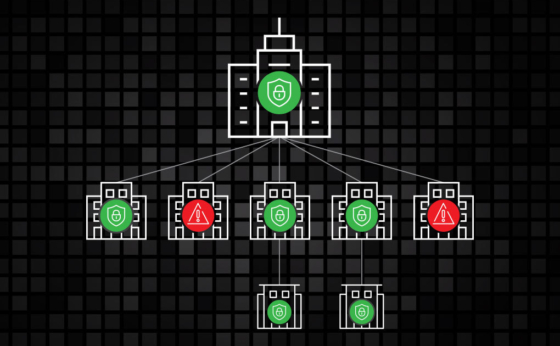

Greater vigilance over authentication protocols and passwordless, biometric security is needed amidst today’s threat landscape.

Relying parties can take action now to promote digital literacy and allow more consumers to benefit from their products and services.

Seeking out third-party security providers that offer enhanced tech is critical to the future of telecoms – but using advanced solutions in-house is even better.

Understanding how biometric data collection functions is key to quelling customers’ concerns around the collection, security, and use of their biometric data.

With FCC 23 95A implementation coming this summer, telcos need to upgrade their security technology to remain compliant and competitive. Learn more.

Wider acceptance of biometrics for travel use cases is reducing friction, increasing customer satisfaction, and streamlining experiences for travelers worldwide.

Healthy outcomes are critical, but recent data show how a positive patient experience can be nearly as important in today’s healthcare landscape. Learn more.

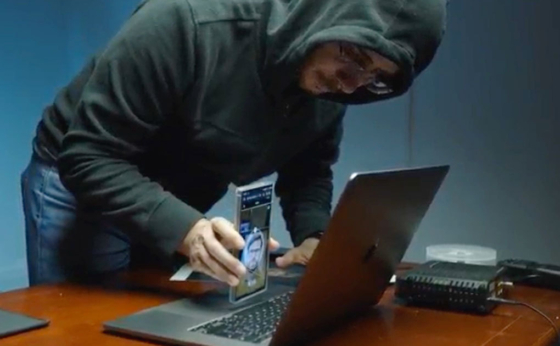

In the shadowy corners of the internet, a new threat emerges: OnlyFake. Learn more about AI-generated fake IDs and how Daon can help combat evolving cyberthreats.

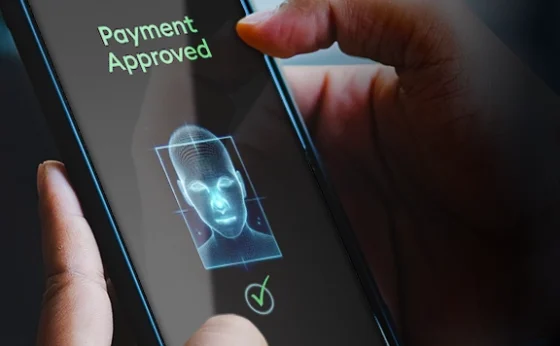

Financial services are turning to biometric verification for safer, faster, and more accessible account and access management. Learn more.

As 2024 begins with fraud top-of-mind for both businesses and customers, here’s a look at the modern fraudster and how to beat them at their own game.

The recent robocall of President Biden has raised international concerns about AI. Here’s how xSentinel can protect against voice deepfakes.

Verifiable credentials and secure biometrics are powering the next generation of digital identity via digital wallets, national IDs, and more. Read now to learn how.

Identity fraud incidence continues to increase as we enter 2024. Businesses across sectors need to arm themselves against generative AI, ATOs, and more.

Digital identity verification can help your organization secure its remote or hybrid workforce through safer account logins, onboarding, and data access.

Watchlists use on-server biometric facial template data to create a powerful barrier against fraud and bad actors. Read more.

Document verification has a wide range of use cases and is critical to ensuring the authenticity of identity documents. Learn how to build instant digital trust.

For industries regulated by age restrictions surrounding media, biometrics-powered digital identity verification is critical.

PAD has emerged as a reliable, secure defense against spoof attacks. Learn how to ensure that only genuine users access accounts and services.

Digital identity certifications establish trust between the service provider and its client. Learn more about certifications, like the UK’s DIATF.

Identity proofing and authentication solutions are critical to the success and security of businesses across industries. Read to learn more.

Face recognition, when combined with step-up authentication, provides an identity assurance paradigm that’s resilient and futureproof.

Password-based authentication is costly for everyone: customers, organizations, and employees. Read how you can better protect your data and your people with passkeys.

The benefits of biometric authentication extend beyond just protection from phishing scams: they can save businesses millions in fraud costs annually. Read more.

Modern digital customers want convenience and security. But how do you protect their data without adding friction to customer experiences? Read to learn how.

Identity verification is the key to keeping your organization and the people it serves secure. Read more to learn how AI can take that process to the next level.

Decentralized identities (DCI) are gaining popularity as a potential solution to the problems that centralized identity management systems present. Learn more.

Voicebots and AI-powered deepfake technology has contact centers being forced to rethink their security strategies. Here’s how Daon xSentinel can help.

Using biometric factors for authentication is the most secure and convenient way to give your customers and employees account access. Learn more.

Multi-factor authentication can help businesses attract and retain customers with convenient UX and highly secured transactions. Learn more.

The FIDO Alliance’s mission is to proliferate ease of use, privacy and security, and standardization surrounding authentication. Learn more.

Digital identity management is a balancing act between security and UX. Biometric authentication is the futureproof solution modern organizations should implement now.

Partnering with a digital identity specialist could have an invaluable impact on your business, from cost savings to customer acquisition to data security. Learn more.

Here’s what every business needs to know about eKYC (electronic Know Your Customer) and how it can secure and streamline onboarding processes across industries.

Biometrics play a key role in the effective implementation of identity verification and authentication for large-scale, secure, digital identity credentialing systems.

Daon’s deepfake fraud indicator, xSentinel, alerts organizations to voice cloning attacks, offering a potent defense in audio-based authentication systems.

Learn about the critical need for continuous innovation in deepfake and synthetic identity detection methods, regulatory policies, and advanced algorithms.

By removing onboarding barriers that people living with disability often encounter, identity verification and authentication fosters equal access for all users.

WebAuthn, a FIDO protocol and an identity authentication standard, allows users to verify their identities without passwords. Learn more about passwordless auth.

eSports organizations are turning to companies like Daon to prevent fraud, especially a form of cybercrime known as smurfing, and to improve player experiences.

Identity Continuity eliminates dangerous gaps between siloed digital identity processes and lets you build customer journeys that create trust, not friction.

Some of today’s most common authenticators are failing to provide the security required to keep IAM systems and customers safe. Read more.

The state of security in UK banks and how modern technology is facilitating more robust customer authentication and improving the identity verification experience.

Let’s look at three terms which comprise the two separate identity processes (proofing and authentication) that are critical for a secure KYC strategy.

Identity fraud losses in 2022 alone amounted to $52 billion. Click here to read which identity verification trends we’re predicting for 2023 and beyond.

Healthcare fraud has significant costs, both financial and non-financial, that affect individuals, healthcare providers, and society as a whole. Learn more.

Daon uncovers generational gaps in adoption rates of identity security technologies and a desire for anti-fraud solutions across ages. Read more.

Providing secure mobile authentication for customers is key to any organization’s success online. Read more to learn about the different methods available.

CIAM-enhanced customer personalization can give you happier, safer, and more satisfied customers – all while protecting your business and its data.

Finding a CIAM solution that meets the unique needs of your organization can help you avoid fines, headlines, and potential lost customers.

Designed to be seamless, invisible MFA provides the same level of security as legacy MFA methods without requiring extra steps for the user.

The ONC Cures Act Final Rule and FHIR implementation is changing digital healthcare. Learn how healthcare organizations and their IT departments must adapt.

Using CIAM (Customer Identity and Access Management) can help any financial organization reach (and keep) customers whose UX expectations are at an all-time high.

Software-defined vehicles are the smartphones of the near future, and they’re powered by customer-centric identity authentication. Read more.

Biometric identity verification provides unique, virtually un-hackable layers of security. And it comes in many shapes and sizes: from who you are, to what you know, to ...

The EBA’s new remote customer onboarding guidelines have just been finalised. Here’s what credit and financial institutions need to know.

Behavioral biometric authentication uses unique, personal characteristics to create a security barrier that is exceedingly difficult to break through. Learn more.

FIDO ID: learn all about the benefits of this safer, more UX-friendly authentication method and how it mitigates mobile channel fraud.

FIDO passkeys, more accurately referred to as multi-device credentials, are cryptographic keys. Learn more about their FIDO2 compatibility.

We surveyed 3,000 anonymously selected consumers. 68% say passwords are their most used, yet least trusted, security measure. Click here to learn why.

Passkeys have been at the forefront of fintech news for months. Will financial institutions embrace a passwordless future, or get left behind?

Identity verification is an important process that can keep you and your personal information safe online, in-person, and on the go. Learn more about how it works.

The UK National Cyber Security Centre (NCSC) recently announced new guidelines to help businesses adopt passwordless authentication. Read their recommendations now.

The need for efficient digital onboarding and identity verification has never been greater. Here’s how these practices are contributing to a better future for business.<...

The inconvenience of using manual processes for physical travel document verification has been around for decades. It’s time to go all-digital.

Synthetic fraud is the fastest-growing form of financial crime today, costing financial institutions an estimated $20 billion per year. Here’s how to stop it.

Here’s what the rise of eSIMs (embedded subscriber identity modules) means for telecom providers, their customers, and their identity verification practices.

Daon’s President of the Americas Conor White shares his top five predictions for where biometrics and digital identity are headed over the next twelve months.

We’re partnering with the BPI Network and the CMO Council to explore consumer attitudes toward current authentication processes and the future of verification.

Here’s how authentication using soft tokens on your smartphone can help you save money, remove friction, and maintain strong security for your customers.

Learn the best ways to keep fraudsters out of your contact center without making true customers feel like suspected criminals.

Here’s a quick primer on how NFC works, its origins in government security, and how those benefits extend to remote identity verification of your new customers.

Here’s the simple blueprint for minimizing caller fraud, reducing handle times and wait times, cutting operational costs, and increasing customer satisfaction.

Hellios attests that Daon has demonstrated strong compliance and satisfied all the requirements to become fully registered on the FSQS supplier qualification system.

Here’s why businesses that master the art of seamless IDV and onboarding attract happier, more loyal customers in less time, with fewer costs.

Most identity processes are just single points of interaction. Here’s why that’s a trust crisis in the making, for both security and usability reasons.

We’re sharing the top 5 ways to eliminate pain points in remote identity verification, so you can onboard customers more swiftly and build higher levels of trust.<...

Unemployment fraud is on the rise, but advanced biometrics make impersonating a citizen exceedingly difficult, even with all the stolen credentials on the Dark Web.

With customers demanding more convenient and safer ways to access their money, here’s how biometrics will shape the next twenty years of banking.